Tax Time For Investors

Interstate Finance & Leasing

June 9, 2025

Tax Time for Investors – Your Opportunity for a Financial Clean-Up

As an investor, tax time isn’t just about lodging a return – it’s a great opportunity to tidy up your finances and ensure you’re maximising all the deductions you’re entitled to.

Top Tip:

Keep detailed records and receipts throughout the year – they’re essential when it comes to claiming deductions.

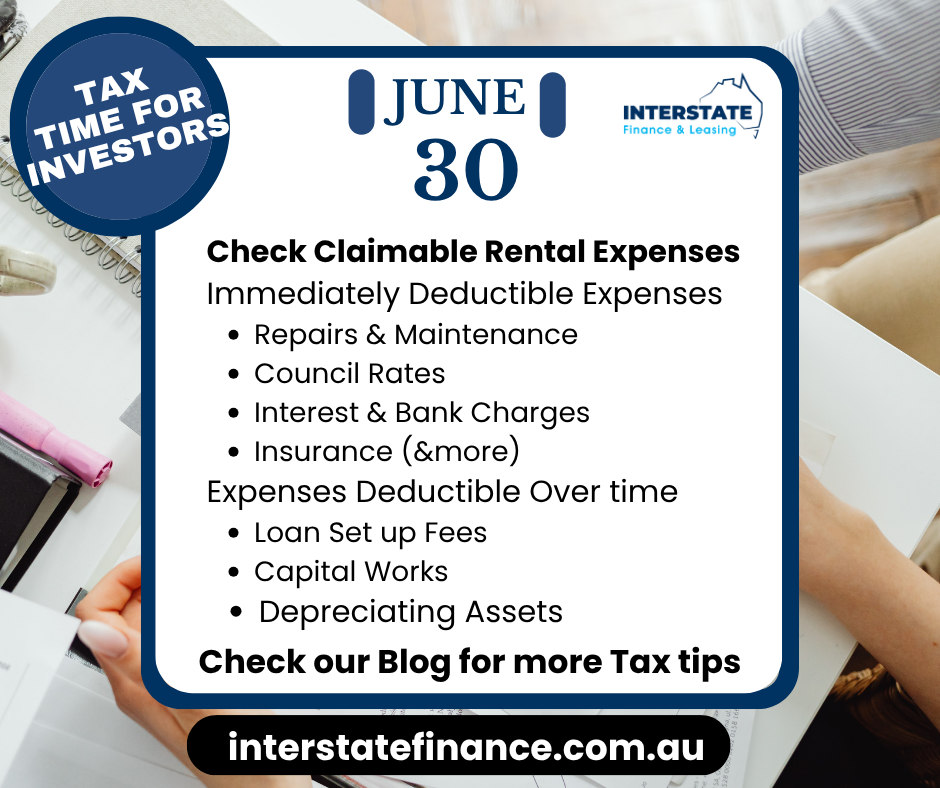

📋 Quick Summary: Claimable Rental Expenses

Rental expenses fall into three main categories:

- ✅ Immediately Deductible Expenses (claimed in the same financial year):

- Repairs and maintenance

- Council rates

- Interest and bank charges on your investment loan

- Insurance (Building, Contents & Landlord policies)

- Pest control

- Depreciating items under $300

- 📆 Expenses Deductible Over Time:

- Loan setup fees (spread over 5 years or the loan term)

- Capital works and improvements (e.g., renovations, structural upgrades)

- Depreciating assets used to earn rental income (e.g., flooring, curtains, large appliances)

💡 Tip: A Quantity Surveyor’s Depreciation Schedule can help identify and clarify what you can claim over time – and your accountant will need this too.

- 🚫 Non-Deductible Expenses:

- Periods when you lived in the property yourself

- Depreciation on second-hand assets purchased after 9 May 2017

⏳ Maximise Your Return Before 30 June

Consider completing minor repairs now to boost your deductions for this financial year.📈 Thinking Ahead?

EOFY is also the perfect time to review your investment’s performance and make plans for the year ahead. If you’d like a hand reviewing your strategy or need guidance on what’s next, we’d love to help.